The industrial real estate market in North Jersey remains incredibly strong, with demand for new space outstripping supply and companies facing challenges with fleet management and premium lease rates for industrial outdoor storage.

Those are among the insights from a panel of experts delivered at the fifth annual Industrial Real Estate Update during the NJTPA’s Freight Initiatives Committee meeting on December 12. The panel included William Waxman, Vice Chairman at Cushman and Wakefield; Steven Beyda, Senior Vice President of Acquisitions at Woodmont Industrial Partners, the industrial arm of Woodmont Properties; and Jesse Harty, Senior Vice President and Market Officer for New Jersey and New York at Prologis.

Those are among the insights from a panel of experts delivered at the fifth annual Industrial Real Estate Update during the NJTPA’s Freight Initiatives Committee meeting on December 12. The panel included William Waxman, Vice Chairman at Cushman and Wakefield; Steven Beyda, Senior Vice President of Acquisitions at Woodmont Industrial Partners, the industrial arm of Woodmont Properties; and Jesse Harty, Senior Vice President and Market Officer for New Jersey and New York at Prologis.

Container traffic through the end of October made the Port of New York and New Jersey the largest container port in North America, on target to move as much as 2 million more Twenty-foot Equivalent Units (TEUs) in 2022 than in 2019, according to Ann Strauss-Weider, Director of Freight Planning for the NJTPA. The port handled 7.6 million TEUs in 2019 and through November is on target to potentially move 9.5 million to 9.6 million this year.

Even in the face of bad news that tenants are hearing – a war in Europe, potential for recession – the demand in New Jersey really hasn’t changed, Waxman said. Growth in recent years has been driven by Amazon and other companies focused on last-mile and quick delivery services, causing pricing in industrial properties to increase 20 to 25 percent year-over-year, according to Waxman.

In the past year, the market has begun to shift from e-commerce to distribution involving food and beverage, cold chain, fulfillment, and life sciences, he said. About 25 percent of tenants in the market now are food and beverage because of the way that grocery delivery has changed. Auto parts companies are also looking to locate in New Jersey. He estimated about 45 to 50 percent of tenants are third-party logistics providers and fulfillment companies.

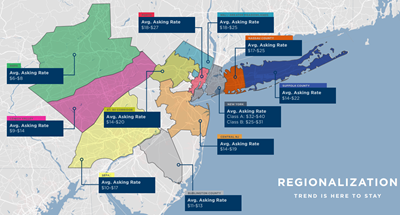

.png.aspx?width=200&height=355) Rising rents have forced some regional and tri-state hubs to locate farther from the port, to Bergen and Middlesex counties, or even farther south and west, where rents are cheaper but also seeing increases as a result. The regionalization trend is here to stay, Waxman declared. A Class A building in New York City could fetch up to $40 per square foot while rents in Middlesex County would be in the $16 to $18 range.

Rising rents have forced some regional and tri-state hubs to locate farther from the port, to Bergen and Middlesex counties, or even farther south and west, where rents are cheaper but also seeing increases as a result. The regionalization trend is here to stay, Waxman declared. A Class A building in New York City could fetch up to $40 per square foot while rents in Middlesex County would be in the $16 to $18 range.

New Jersey is now one market, not just south, central and north, Harty said. Before, some people wouldn’t look as far south as Exit 8A on the New Jersey Turnpike or beyond. “Now, all of New Jersey is in play.” Even so, recent rising interest rates have added uncertainty to the market including about what buildings are worth, he said.

While Waxman doesn’t expect growth in property prices to continue at 20 to 25 percent a year, he also doesn’t expect rents to come down. He estimated about 140 million square feet is being built in 10 counties of northern and central New Jersey. Vacancy has begun to grow a little bit, which has slowed the increase in rental fees.

Industrial Conversions

Over the past two years, about 7.8 million square feet of office space has been converted to industrial within north and central New Jersey, mostly located in former office parks in Bergen, Middlesex, Morris and Somerset counties.

.png.aspx?width=250&height=140) With statewide office space vacancies at about 20 percent, there will be other conversions, Beyda said, as developers “reconsider and re-evaluate what highest and best use of the property is.” These office buildings tend to be concentrated in locations with strong labor, so developers are taking buildings that have become functionally obsolete and repurposing them for industrial. Some former retail space has also been converted, though often that presents greater challenges for developers.

With statewide office space vacancies at about 20 percent, there will be other conversions, Beyda said, as developers “reconsider and re-evaluate what highest and best use of the property is.” These office buildings tend to be concentrated in locations with strong labor, so developers are taking buildings that have become functionally obsolete and repurposing them for industrial. Some former retail space has also been converted, though often that presents greater challenges for developers.

Mega developments in New Jersey, like the Linden Logistics Center in Union County, and Kingsland Meadowlands in Lyndhurst, Bergen County, are unique because they consist of large tracts of available land in prime locations for industrial uses. Harty said developers will need to get more creative to meet demand, noting that site constraints and the cost to buy land in New York City are driving multi-story industrial developments. “We’ll see if this comes to New Jersey.”

Industrial Outdoor Storage

Panelists agreed that there will continue to be strong demand for industrial outdoor storage, whether for trucks or containers.

“A lot of municipalities are against these but it’s huge to keep our economy running,” Harty said. “Where are we going to put all these trailers when they’re not in use?”

Another big challenge is a lack of overnight trailer parking in rest areas, which leads to trucks parking along roads. “People cannot get enough of it,” Harty said. “It will be a major focus of users going forward.”

A recording of the meeting is available here and meeting presentations here.