The trucking industry is grappling with two challenges affecting many industries – supply chain issues and how to mitigate climate change.

These were the topics of the Trucking Industry Update at the NJTPA Freight Initiatives Committee’s June 21 meeting.

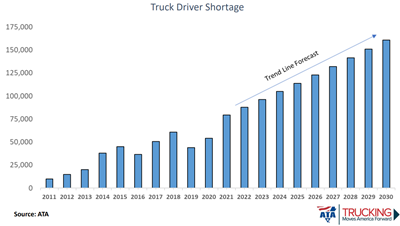

The truck driver shortage is expected to double from an estimated 80,000 last year to 160,000 by 2030, Nicholas Geale, Vice President of Workforce and Labor Policy at the

American Trucking Associations, said during his presentation.

Freight volumes have slowed from 2021 but remain elevated, according to Geale. While freight is transitioning back from the spot (one-time delivery) market to contracts, contract loads have struggled to fully return to pre-pandemic levels due to a lack of drivers and equipment, he said.

The p

The pandemic years have been good for trucking generally, according to Geale, with lots of goods being transported, tight capacity and higher rates. Costs have been a challenge, however, when it comes to driver wages, retention and recruitment, liability insurance, equipment prices and availability, and spikes in fuel prices. Many fleets, especially smaller ones, could be in trouble in the next recession, Geale said, noting the potential for consolidation.

Constraints of supply and the lack of equipment and microchips are reaching the trucking industry just as any other. But he noted that the driver shortage is boosting wages.

“If you’re a truck driver, you’re probably the only person in America beating inflation the last three years,” Geale said, with 8.5 percent average annual increases since 2019 for long-haul truckers. “It will take a while to dig out of this supply hole, so driver pay will continue to increase.”

Drivers working fewer hours, due to federal hours of service requirements, and the average driver age reaching nearly 50, means the shortage will only get worse. Geale said the industry needs to work on attracting younger recruits and women, that later of which are only 7 percent of drivers.

“We need to do a better job of telling people about good jobs in the industry,” Geale said. “We can’t fill these jobs unless we make a long-term investment in our people and make it a job people want to be in because it’s a career and has long-term growth.”

In the short term, there are programs like the DRIVE Safe Act apprenticeship program and a task force that aims to increase the number of women in trucking. He emphasized making truck drivers a national in demand position for workforce training funds. In the longer term, Geale said it’s about expanding the poolto attract more women, former felons, young people, urban populations, and veterans among others.