Freight

The NJTPA region is the platform for the distribution of goods to one of the largest consumer markets on earth. This encompasses the New York-New Jersey-Connecticut metropolitan area and much of the mid-Atlantic and New England states. The region is also a leading US international gateway with the largest port on the Atlantic Coast and one of the largest air cargo operations in the US.

The NJTPA region is the platform for the distribution of goods to one of the largest consumer markets on earth. This encompasses the New York-New Jersey-Connecticut metropolitan area and much of the mid-Atlantic and New England states. The region is also a leading US international gateway with the largest port on the Atlantic Coast and one of the largest air cargo operations in the US.

The region’s freight system includes:

Port: Northern New Jersey is the home of the largest container port on the Atlantic seaboard. The Port handled 7.8 million TEUs in 2023. Cargo volumes declined from the significant amount handled in 2022 and returned to their pre-pandemic trajectory, a 4.4 percent growth from 2019. The rail moves inland at the Port totaled nearly 629,200 in 2023. The Port also handled 366,796 vehicles, 3.1 million metric tons of bulk cargo, and 1,181,487 cruise passengers during 2023. Source: Port Authority of New York and New Jersey

The Port of New York and New Jersey continues to serve as an integral part of the economic performance of the region. According to the 2023 Economic Impact Study undertaken by NJTPA as a member of the Council on Port Performance, the port industry grew substantially, supporting 563,700 jobs and almost $200 billion in economic activity, including federal and state tax revenue, business and personal income.

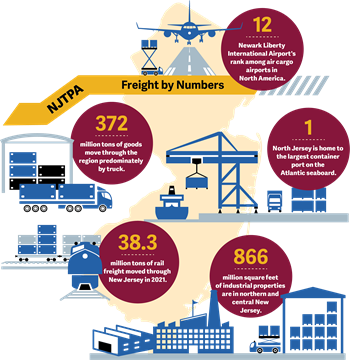

Rail: Northern New Jersey is served by two Class I railroads—CSX and Norfolk Southern, a regional railroad (the New York, Susquehanna & Western), and several short line railroads. This region also includes the Conrail Shared Assets Area and extensive on- and near-dock rail operations that serve the Port. In 2021, New Jersey had 15.7 million tons of rail freight originating in the State and 22.6 million tons terminating in the State. Source: The Association of American Railroads.

NJTPA Freight Planning Tools

|

|

| Click on the icons above to access the interactive tools. |

Air: During 2023, Newark Liberty International Airport handled nearly 686,700 tons of air cargo. In 2023, the three leading airlines in terms of cargo volume were Federal Express, United and UPS. In 2022, the Airport was ranked as the 12th largest air cargo airport in North America and 39th in the World. Source: Port Authority of NY and NJ

Trucking: Trucking moves the most freight in the NJTPA region. More than 78 percent of the total 372 million tons of goods moved in the region were handled by trucks. Source: NJTPA 2050 Freight Industry Level Forecasts Study.

Industrial Properties: As of the first quarter of 2024, northern and central New Jersey had 866 million square feet of industrial properties, one of the leading concentrations in North America. New buildings totaling 2.6 million were delivered to the market, and 3.5 million square feet of new construction started. Vacancies continued to increase during the quarter. The largest deal was a new lease of a 1.28 million SF building to the TJX Company in Lyndhurst. Excluding the TJX lease, the companies leasing or renewing were comprised of 39% third party logistics companies, 24% food service and 22% wholesale/retails companies. Source: CBRE

Freight planning activities at the NJTPA are guided by the Freight Initiatives Committee. Meetings of the committee serve as a forum for discussion of regional freight issues. The committee makes recommendations on action items to be considered by the full NJTPA Board of Trustees. The committee meets bimonthly. Its meetings are open to the public. You can sign-up for notices of freight-related news, events and meetings through the NJTPA E-list.

Freight planning activities at the NJTPA are guided by the Freight Initiatives Committee. Meetings of the committee serve as a forum for discussion of regional freight issues. The committee makes recommendations on action items to be considered by the full NJTPA Board of Trustees. The committee meets bimonthly. Its meetings are open to the public. You can sign-up for notices of freight-related news, events and meetings through the NJTPA E-list.

The NJTPA established the Freight Concept Development Program (FCDP) to advance regional and local freight initiatives identified through planning studies conducted by the NJTPA, its planning partners and its subregions. The Pilot Freight Concept Development Program developed the FCDP and completed two studies. The FY2021 Freight Concept Development Program Studies completed two additional studies.

Examples of freight projects and programs in the Transportation Improvement Program include:

- Port Street Corridor Improvement Project (Project ID: PA2201)

- Delancy Street, Avenue I to Avenue P in Essex County (Project ID: NS0504)

- Kapkowski Road – North Avenue East Improvement Project (Project ID: 17339)

- Portway, Fish House Road/Pennsylvania Avenue, CR 659 in Hudson County (Project ID: 97005B)

- Local Freight Impact Fund Program (Project ID: 17390)

- Maritime Transportation System (Project ID: 01309)

- New Jersey Rail Freight Assistance Program (Project ID: X34)

The 2023 New Jersey Statewide Freight Plan is now available.

Current and recently completed NJTPA freight planning initiatives are listed below. Past initiatives can be found on the NJTPA Studies page:

Current Projects & Studies

- 2050 Freight Industry Level Forecasts Update

Conditions in the goods movement industry have rapidly evolved over the last several years. The 2050 Freight Industry Level Forecasts Update Study will develop updated, accurate information on freight demand, both current as well as projected out to 2050 and 2055. - Truck Parking Analyses

Truck parking shortages are local, regional and national safety concerns. NJTPA has identified four types of parking considerations: (1) Federal hours of service (HOS) rest requirements, (2) staging for freight facilities, (3) emergency truck parking, and (4) secure locations where drivers can park their tractors when off-duty. NJTPA continues to identify and assess effective practices to address each of these concerns. The database on HOS related parking facilities is routinely updated in coordination with NJDOT and the MAP Forum members. The current HOS database can be found in the Freight Activity Locator. NJTPA also continues to hold meetings and webinars on the subject to advance collaborative solutions.